Christmas bounty as Brisbane house prices crack record growth figures

Latest figures released today show home prices around the nation increased in December to a new record high, with Brisbane homes tipping over a major milestone.

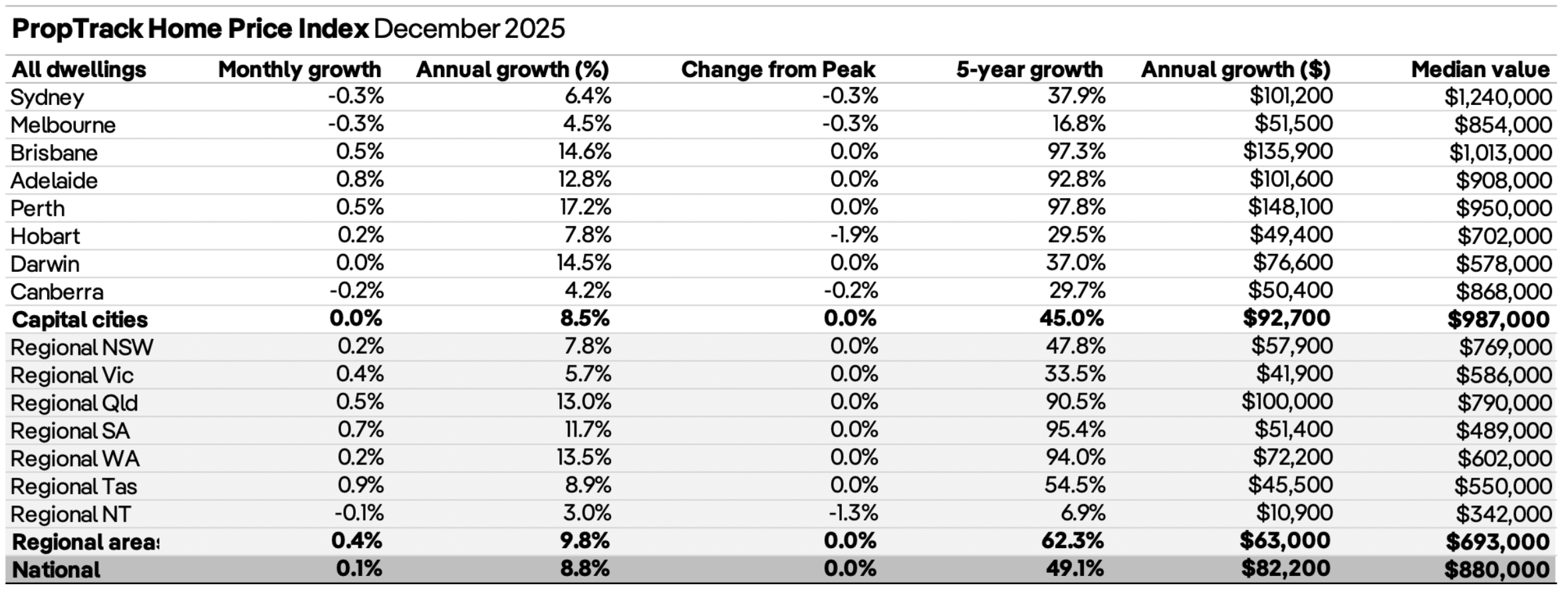

Entering the property market just got a bit harder after the national home price reached a record $880,000.

And the median price for a home in Brisbane tipped over the million-dollar mark to $1.01 million as the booming Queensland capital recorded annual growth of 14.6 per cent.

This means the median house price grew by $135,900 over the course of 2025 to hit six figures, which is equal to the city’s historic peak.

Brisbane was the second most expensive property market in the country, after Sydney, and trumped Perth and Adelaide in third and fourth positions, respectively.

You might like

The new national high in December followed monthly growth of 0.1 per cent, and growth of 8.8 per cent over the year, the PropTrack report released on Monday found.

Home prices in Sydney and Melbourne fell in December, each dipping by 0.3 per cent, but despite this prices were still higher than a year ago.

The median home value in Sydney hit $1.24 million, after annual growth of 6.4 per cent, while Melbourne recorded $854,000 after a yearly gain of 4.5 per cent.

Adelaide was the best performing capital city in December with home prices up 0.8 per cent to a median $908,000 after a 12.8 per cent rise over the year.

Stay informed, daily

Perth also saw strong numbers, with 0.5 per cent growth in the month, in line with Brisbane, to a median value of $950,000 after annual growth of 17.2 per cent.

Regional areas outperformed the capitals throughout 2025, recording 0.4 per cent growth over December, the report found.

“Home prices are predicted to head to new highs in 2026, however, the pace of growth is expected to slow,” REA Group senior economist and report author Anne Flaherty said.

“Price growth in 2025 was supported by three rate cuts.”

With no further interest rate cuts expected in 2026, there is a possibility rates could rise if domestic inflation persists.

But limited housing supply and persistent demand could counteract any rate hikes by the Reserve Bank of Australia.

“The Australian government’s five per cent deposit scheme is also likely to support price growth by driving up demand, particularly at the more affordable end of the market,” Flaherty said.

As well, increasing building costs and a tight labour market for construction trades will continue to keep housing supply far below what the country requires and could therefore drive house prices up.

Data published by PropTrack rival Cotality on Friday found Australian home values had surged by 8.6 per cent in 2025, adding about $71,400 to the national median dwelling value.

It was the strongest calendar year gain in home values since 2021, when the market rose 24.5 per cent amid emergency low interest rates and record-high purchasing activity during the pandemic.